For 23 years, Marc Benioff has ferociously battled the status quo of IT.

For 23 years, Marc Benioff has passionately preached a new and better way to do business.

For 23 years, Marc Benioff has been the fearless champion of a world-rocking new category, as outlined brilliantly in Christopher Lochhead’s seminal book, Play Bigger.

For 23 years, Marc Benioff has hectored his competitors, charmed investors, earned the trust of hundreds of thousands of customers, made Salesforce an iconic global brand, and relentlessly grown the company’s revenue. Every. Single. Quarter.

A few months ago, Salesforce surpassed SAP as the world’s largest provider of enterprise apps as the first major milestone on Benioff’s audacious commitment to growing annual revenue from its current annualized run rate of $31 billion to $50 billion in just over three years.

Having ascended to the mountaintop, the battle is now Salesforce’s and Benioff’s to lose.

Can SAP rebound and catch Salesforce? Anything’s possible, but I don’t see that happening because SAP’s fast-growing cloud business has only just overtaken its traditional and no-growth on-premises business as the biggest revenue contributor within SAP. That multiplier — $3.12 billion for the quarter ended June 30 — simply isn’t big enough to power a comeback of the size SAP needs.

What about Oracle? Now that’s an interesting question, which I’ll dig into in more detail at another time. Here’s why it’s interesting: a pretty big chunk of Salesforce’s $7.72 billion for the quarter ended July 31 comes from products and services other than applications, and the same is true of SAP’s $7.52 billion for the 3 months ended June 30. So the precedent has been set for counting total revenue, not just revenue very specifically from applications.

In that context, should Oracle be considered as a candidate for the biggest apps provider? No doubt it gets big-time revenue from database sales, and I’d have to think about how to classify its cloud-infrastructure revenue since a lot of that is actually software…. Well, as I said, that’s a subject for another day.

But clearly, it shows that the neat revenue buckets set up by vendors can be at odds with how customers are using cloud products and services — and in my view, the determining factor is simply this: Build the categories and classifications around what customers are doing, not around the tired classifications that some third-party ivory-tower theoreticians have cobbled together.

So, here’s my take on what adds up to a 10-point plan from Benioff and Salesforce to boost annual revenue by 50% in just over 3 years (specifically by Jan. 31, 2026, which is the end of the company’s FY26).

1. Rub the lamp and flood the market with the new shiny object called Genie.

At its core a data lake — and the definition of what one of those is will surely keep evolving over time — Genie is Salesforce’s New Big Thing. During Salesforce’s Investors Day forum on September 21, Benioff and co-CEO Bret Taylor used the terms “amazing” and “incredible” to describe Genie so many times that I lost count.

More telling to me is that just a few months ago, Salesforce’s 500 top execs — and this anecdote came straight from Benioff during Investors Day — were baffled by the product at an internal-only debut. As outlined in my recent piece called Salesforce Goes for the Kill — Prematurely, those 500 top execs watched Benioff do a demo of Genie and their collective reaction was, in Benioff’s own words, “We don’t get it.”

Can Genie turn out to be a great advance for Salesforce and its customers? Yes, it can — but not if it baffles 500 of the companies’ leaders who are supposed to evangelize it and sell it. But Benioff says the inclusion of bunny ears and a tweak here and there have solved all that confusion, and that Genie is an unprecedented runaway success.

Now, that’s the sort of yarn Benioff perfected when he and his company were the upstarts, the rebels, the challengers, the feisty alternatives who fired first and aimed later. But now that Salesforce is the top dog, it will be expected to be more disciplined, more buttoned-down, and more precise.

Such is the price of fame and glory — but if Genie is not a smashing success, this episode will come back to bite Salesforce.

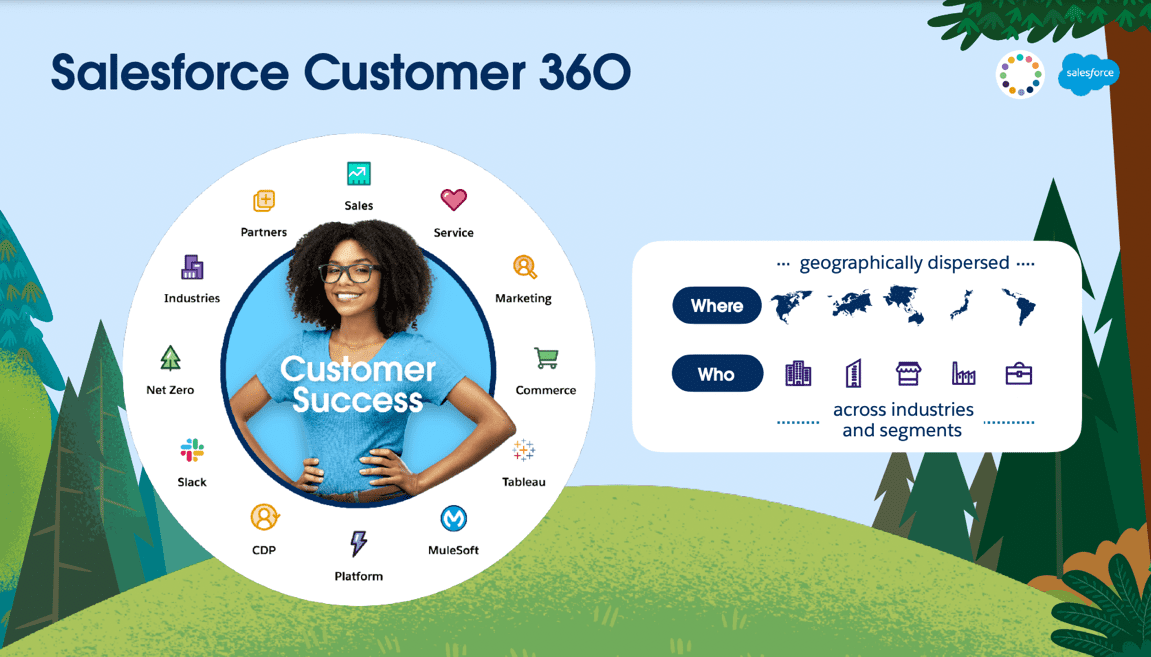

2. With Customer 360, who needs anything else?

Well, that’s the story Salesforce is pushing hard. But just as Salesforce’s own product portfolio has evolved in massive ways over the past few years, imagine what it will need to be like 2-3 years from now. In my opinion, Salesforce is taking a huge risk — and possibly making a big mistake — when it tells the world that we offer everything you need.

I believe Benioff and Co. will need to be very, very careful with this line of thinking because as much as they would like it to come true, history shows that customers strongly resist the all-for-one approach.

This is a time for Salesforce to stop thumping its chest and positioning this as “customer like this because we make it” and instead convince people that this is where the world of business is headed, and we’re going to help you get there and thrive in the new digital world.

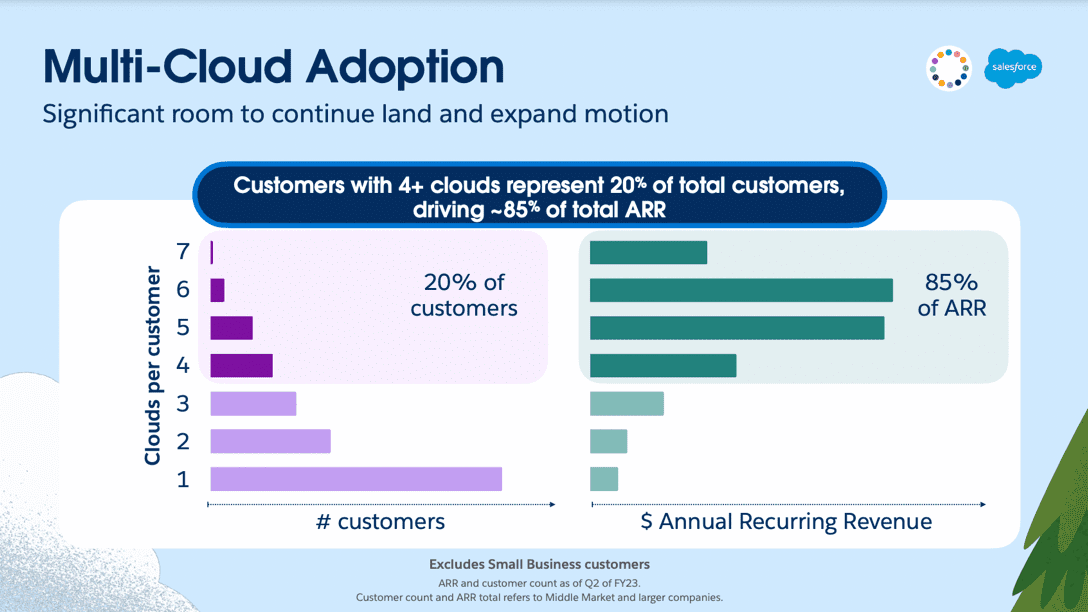

3. Selling multiple clouds to the same customer is nirvana.

This is an incredibly powerful slide — and if Salesforce can take this reflection of past behavior and create a future in which this model is sustained, the company will be very hard to beat. But as shown in #1 and #2 above, I think Salesforce isn’t yet close to mastering that subtle but essential change in personality.

But just take a look at the power of happy customers whose experience — not Salesforce’s chest-beating — leads them to buy more and more from Salesforce, which in turn reaps enormous financial rewards from that hard-earned loyalty.

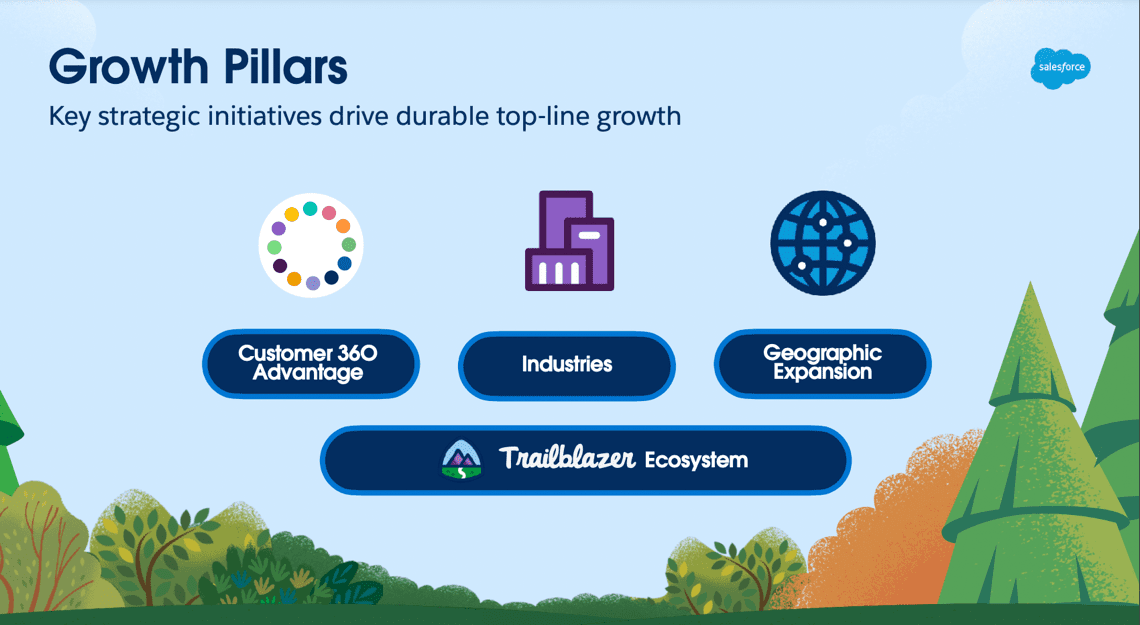

4. Three Essential Growth Pillars

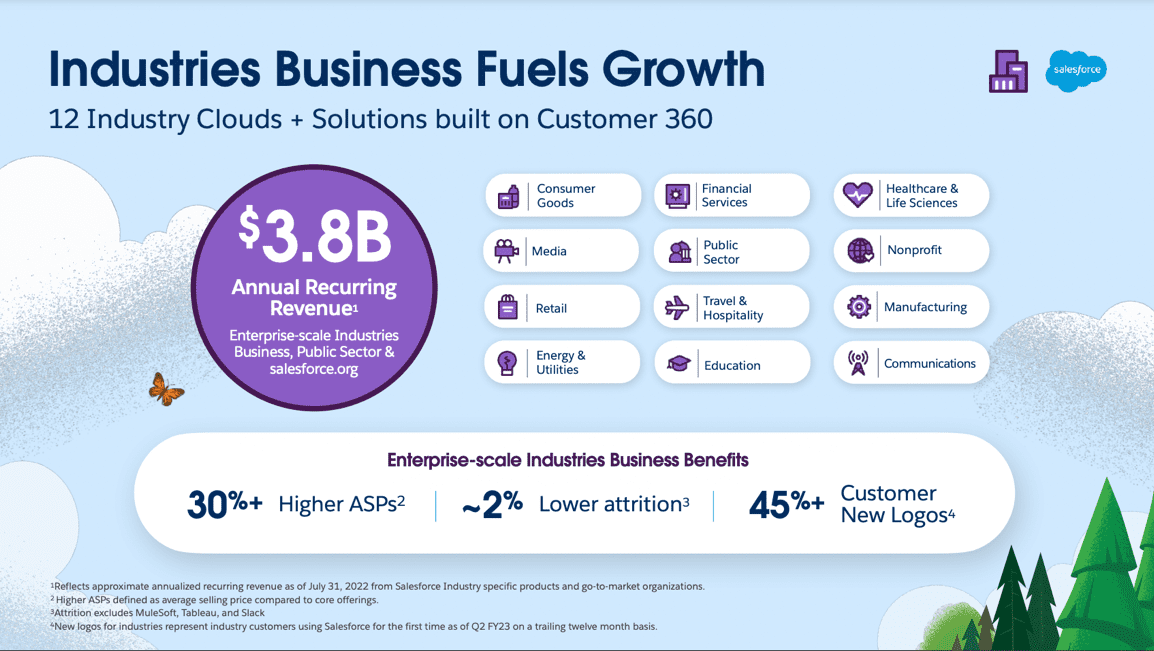

The big and robust product portfolio (see #2 above) geographic expansion outside North America and Industries represent big-time growth opportunities for Salesforce. I took a close look at the Industries to play in Why Salesforce Loves Industries: $3.8 Billion, 33% Growth, Higher Prices, New Logos, and continue to believe this is an area of extraordinary opportunity for Salesforce. In fact, president of products David Schmaier said this during Investors Day: “Industry Solutions are the fastest path to digital transformation for our customers.”

5. The “20-80 Rule” Strikes again — with enormous impact.

To give another perspective on how incredibly powerful this multiple-cloud dynamic is for Salesforce, check out this slide from CFO Amy Weaver’s presentation:

So, 20% of Salesforce’s customers drive 85% of its ARR — and the more they buy, the more loyal they become. This is another indication of why Salesforce needs to make more of this powerful story about its customers, and less about its own inevitable rise to dominance.

6. Industries: Higher Prices, Lower Attrition, Oodles of Net-New Customers

As they say in Brooklyn, “What’s not to like?” And this is yet another piece of evidence I will deploy to buttress my argument that in a very short period of time, all enterprise applications will be either industry-specific or industry-enhanced. There’s simply too much inherent value for customers for this to play out any other way.

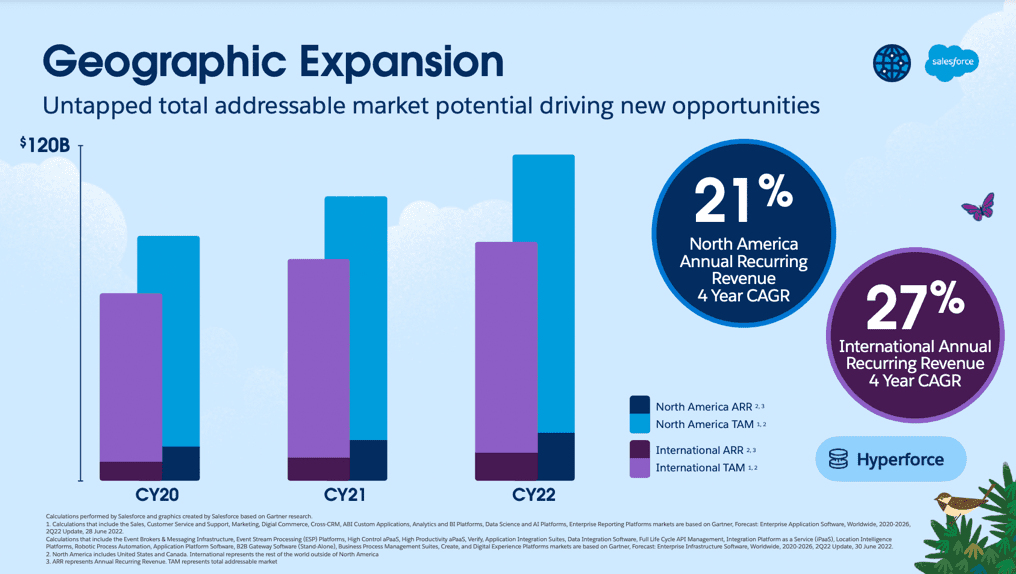

7. Big Growth Opportunities Outside the U.S. and North America

As well as Salesforce is doing with its massive North America business, its growth rate outside that region is almost 30% higher, revealing huge potential.

8. The Rise of Solution Selling

Not a lot of conversation about this during Dreamforce, but this line from co-CEO Bret Taylor during Investors Day grabbed my attention as something Salesforce could — and should — capitalize upon: “And you could just imagine, with the current supply chain crisis I’ve seen so many retailers work with their suppliers using Tableau to visualize both for pricing and inventory their supply chain, and then using Slack to connect channels to work with our partners to actually debug it. And we’re really trying to package this all up into real solution selling.”

If Salesforce is able to make that pivot to solution selling in a world where one size not only doesn’t fit all but doesn’t even fit that many, it could be a huge win for Salesforce.

9. The AWS Connection

When the world’s biggest cloud-infrastructure provider (that would be AWS) and the world’s biggest enterprise-apps vendor (you know who that is) take a strong relationship and make it even stronger, the impact can be enormous. In a Q&A session, one financial analyst asked co-founder Parker Harris about the AWS relationship and buttressed that by saying he counted 30 AWS sessions at Dreamforce.

Here’s a key part of Harris’ response: “They’re one of our biggest customers, and we’re a big customer of theirs so it’s a very deep relationship. Then we listen to our customers, and what our customers are saying is, ‘Hey, I’ve got a lot of workloads that are on Amazon. I’ve got my data lake on Amazon already. I’m already doing AI with Sagemaker. Don’t tell me I can’t get the value from that.’ ”

Those are the type of deep and challenging conversations that make relationships stronger by forcing both parties to focus more on what each does uniquely well and not put customers at the center of an intramural squabble.

10. Benioff’s Big Vision

Hey, as outlined at the top, it’s worked for 23 years, and there’s no reason to suspect Benioff is losing his touch for not just seeing the future — although that’s hard enough — but creating the future. That’s part of the burden of being #1: everybody’s after you, everybody’s looking for weaknesses, and the market’s tolerance for missteps has shifted from very slight to absolute zero.

Being #1: they wished for it and they got it.

Now, can they keep it?