With Salesforce and SAP forecasting cloud revenue for 2023 that will total more than $51 billion, it’s clear that one of the greatest growth markets in history has not come even close to reaching its full potential.

SAP and Salesforce both held investor-day events last month, and their respective presentations included revenue projections for calendar 2023. Salesforce said its 2023 revenue—which is all cloud—will reach $35 billion. Meanwhile, SAP forecast that its 2023 cloud revenue will be at least $16.5 billion.

(I’m taking a very slight license here, as Salesforce’s projections are in fact for the 12 months ending Jan. 31, 2024, which marks the end of its fiscal 2024.)

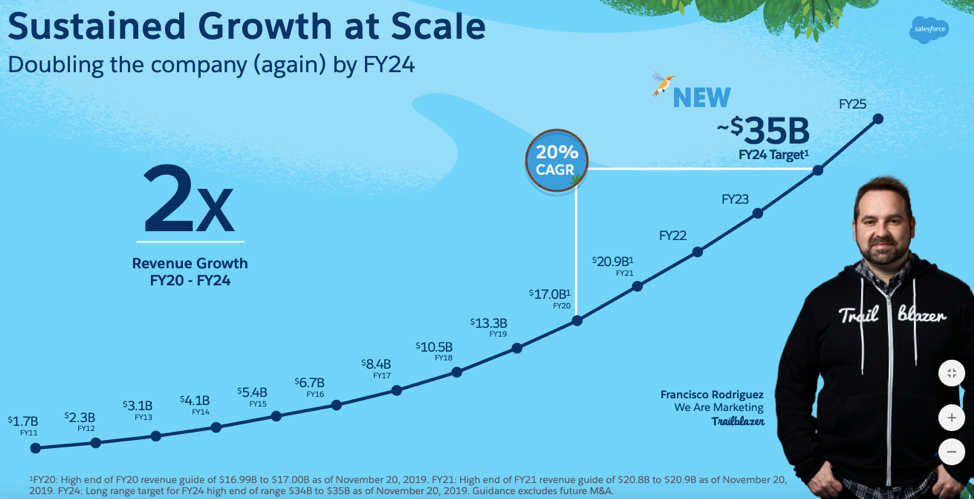

As I analyzed in a recent post headlined How Salesforce Plans to Defeat Oracle and SAP While Scaling to $35B, Marc Benioff has committed to doubling his company’s revenue over the next four years, as shown in this slide from the Salesforce investor-day presentation:

That’s a staggering commitment in today’s viciously competitive marketplace. But I believe Salesforce makes a compelling case for how it can get there.

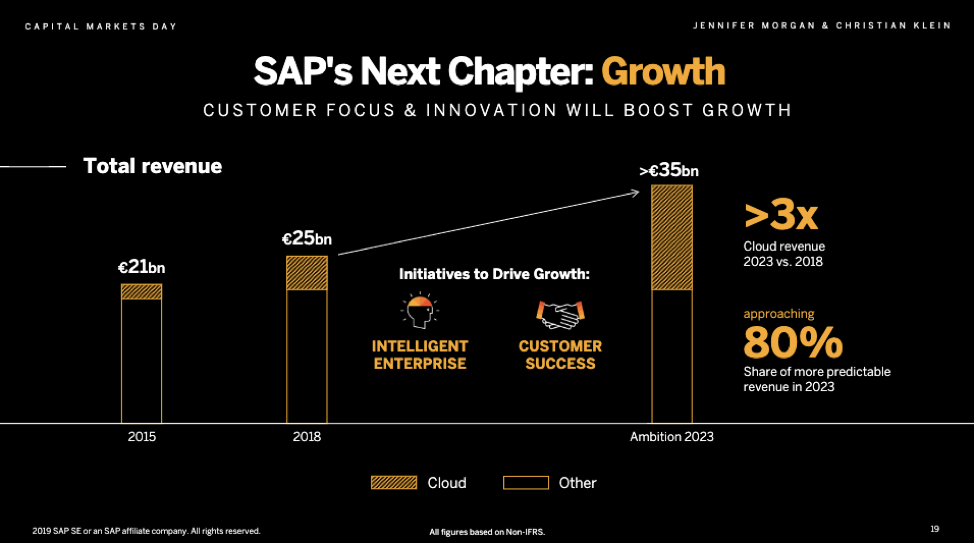

At SAP’s Capital Markets Day, the company projected total calendar-2023 revenue of 35 billion euros. At today’s exchange rate of 1.11, that equates to $38.85 billion.

That huge number includes both cloud and non-cloud revenue, so I’m basing my informed estimate of SAP generating about $16.5 billion in 2023 cloud revenue from this slide, which shows that more than 40% of that total 2023 revenue of $38.85 billion will come from the cloud:

While we’ve got the crystal ball out, let’s toss a few of the other major SaaS/PaaS players from the Cloud Wars into the mix and see where that takes us. (Please note: while the Salesforce and SAP estimates above come from public presentations to investors, the numbers below are my own rough estimates and are not based on any specific information from any of the companies named.)

- #5 Oracle: For calendar 2023, Oracle has a good shot at having SaaS revenue of close to $10 billion. The wild card here is when we shift over the the PaaS layer and consider Oracle’s high-growth Autonomous Database. If it comes anywhere close to the optimistic outlooks Larry Ellison has offered, by 2023 the Autonomous Database could have revenue of at least $5 billion. It could perhaps go as high as $8 billion or $9 billion. So in light of that wild card, let’s peg Oracle’s 2023 SaaS and PaaS revenue at $15 billion.

- #8 Workday: Building off calendar-2019 foundation of about $3.5 billion, and currently growing at more than 30%, Workday’s got a good shot at finishing 2023 with at least $8.5 billion in revenue.

- #9 ServiceNow: Incoming CEO Bill McDermott has offered some heady growth projections for ServiceNow, which like Workday will finish 2019 at close to $3.5 billion in revenue. If McDermott can boost the company’s current growth rate beyond 30%, might he have a shot at $10 billion in revenue for 2023? Let’s call it $9 billion.

The Big Total: across those 5 companies—the formal projections from Salesforce and SAP, and my back-of-the-napkin projections for Oracle, Workday and ServiceNow—we get a total estimated 2023 revenue figure of $84 billion. And that does not include any IaaS—just SaaS and PaaS.

It also, by the way, does not include any contributions from the following companies, which take us outside of the SaaS/PaaS categories outlined above:

- #2 Amazon, whose AWS unit could well have 2023 revenue of $60 billion;

- #6 Google Cloud, which does not break out revenue figures and so could be just about anywhere you can imagine by year-end 2023 (but regardless, I’ll guess $15 billion for its SaaS/PaaS revenue for 2023); or

- #7 IBM, which could hit $43 billion in 2023 cloud revenue if it can grow 20% per year for the next few years.

And of course, we haven’t yet mentioned #1 Microsoft, which will finish this calendar year with cloud revenue of about $44 billion. Of that, perhaps half is from SaaS and PaaS, or about $22 billion. With the astonishing growth rates Microsoft has consistently rung up over the past few years, it’s not crazy to suggest that Microsoft’s SaaS/PaaS revenue for calendar 2024 could be at least $50 billion.

So let’s see: $84 billion from the 5 vendors at the top; plus about $118 billion from Amazon, Google and IBM; and then about $50 billion from Microsoft.

By my reckoning, that’s about $250 billion in SaaS/PaaS revenue for calendar 2023 from those 9 companies.

Looks like the Cloud Wars are only getting warmed up!

RECOMMENDED READING

SAP and Oracle’s Larry Ellison Just Can’t Agree: Who’s #1?

Amazon Jilted as Salesforce and Microsoft Pair Up for IaaS and Teams

How Salesforce Plans to Defeat Oracle and SAP While Scaling to $35B

SAP after Bill McDermott: Crush Product Silos, Focus on Customer Success

SAP Says HCM Is Dead—Can Qualtrics Transform it to HXM?

Google Cloud Q3 Growth Triggered by Compute, Data Analytics and G-Suite

IBM Cloud Unleashes its True Competitive Advantage: Tech Plus Industry Expertise

Disclosure: at the time of this writing, SAP, Oracle, Google Cloud, IBM and Workday were clients of Evans Strategic Communications LLC and/or Cloud Wars Media LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!