Since Gartner, the big dog in IT research and advisory services, has just released its guesses regarding 2020 worldwide IaaS public-cloud market shares for Amazon, Microsoft, Google and others, I’d like to share some of their guesswork and ask a few questions.

The first of those questions is posed in the headline: do you trust Gartner? I’ve been hearing more and more people answer that either in the negative or with a qualified “sometimes.”

But regardless of how much or how little credibility you feel Gartner deserves, there is no denying that Gartner has hammered its way to the top of the heap among IT analyst firms and wields significant influence on some buying decisions. So clearly, there are still a lot of businesspeople who either trust Gartner or who feel that Gartner’s value as a CYA bucker-upper is worth an annual contract.

No doubt Gartner has some terrific people, and I’m sure some of its work is stellar. But in a world that’s moving and changing and evolving faster than ever before, it seems to me that Gartner frequently resembles Elmer Fudd trying to keep up with Bugs Bunny: overmatched, out of its depth, unable or unwilling to adapt to modern times and clinging to a past that is wholly incompatible with the present and the future.

To back up that claim, please allow me to present Exhibit A: in its June 28 press release announcing its IaaS market-share findings for 2020, Gartner begins a sentence with this assertion: “While the cloud market will continue to grow, …” Now, I’m not sure what possible follow-on blockbuster revelation in the second half of that sentence could ever justify that preposterously silly opener—“While the cloud market will continue to grow.” But I will say that if I were a CIO or CFO or some other high-level decision-maker, I’d have to wonder why the hell I’m paying this outfit hundreds of thousands or millions of dollars a year to tell me that the sun’s gonna rise in the East tomorrow!!

For cripe’s sake, the enterprise cloud is only the greatest sustained growth market the world has ever known! And Gartners’s big divination is that—wait for it!—“the cloud market will continue to grow.”

But to me, that captures the Gartner mindset: belabor the obvious, fall back on the inarguable and above all don’t look too closely at what’s really going on in today’s madcap world because doing so could force some Gartner leaders to actually have to drive change—big changes—within their company and their business model.

However, in spite of myself, I looked at the Gartner press release about the IaaS numbers. And yes, I know, I know, the press release offers only tiny morsels of what’s in the big fat report Gartner’s hawking, so I didn’t really expect the press release to lay bare the future of the enterprise-tech business.

But here are a few things that press release did say.

- Gartner’s guess: “While the cloud market will continue to grow,…” Now, I might have mentioned this already, but it’s such a reality-rattler that I’m not sure so I wanted to build in some business-continuity redundancy.

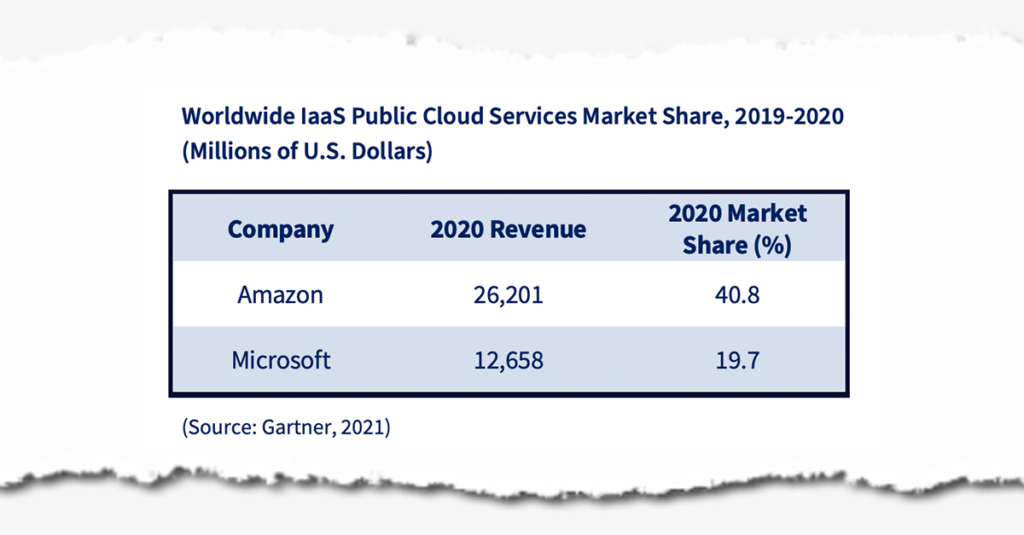

- Gartner’s guess: Amazon had 2020 IaaS public-cloud revenue of $26.2 billion. Who knows—Gartner’s guess might be fairly close to being on target. And for the heck of it, let’s say it is. That would mean that public-cloud IaaS revenue accounted for 57.8% of AWS’s total 2020 revenue of $45.3 billion. And that means that AWS had “other” cloud revenue in 2020 totaling $19.1 billion. Would’ve been nice for Gartner to share its guess on what that $19.1 billion consisted of: databases, integration services, AI services, analytics??

But that type of 360 thinking isn’t how Gartner operates. The press release is about public-cloud IaaS revenue, dang-git, so stay focused on the one-dimensional thinking we’re offering you!!

- Gartner’s guess: Microsoft had 2020 public-cloud IaaS revenue of $12.7 billion. Again, let’s play along and assume Gartner’s guess is close to being accurate. Then, to determine what percentage of Microsoft’s overall cloud business that represents, we use the primary revenue category that Microsoft uses every quarter to define its overall cloud business—commercial cloud revenue—and add up those quarterly figures for calendar 2020. Those numbers are Q1 $13.3 billion, Q2 $14.3 billion, Q3 $15.2 billion and Q4 $16.7 billion for a calendar-2020 total of $59.5 billion in commercial-cloud revenue. That means that if we use Gartner’s guess, then public-cloud IaaS revenue accounted for 21.3% of Microsoft’s total commercial-cloud revenue. It also would indicate that, outside of public-cloud IaaS revenue, Microsoft generated 2020 commercial-cloud revenue of a whopping $46.8 billion, which is more than $1 billion larger than AWS’s total cloud revenue for 2020.

It would have been compelling to have seen what the big brains at Gartner might have had to say about these and other issues:

- What the heck is in that $12.7 billion in public-cloud infrastructure revenue, and what is in the almost-4X-as-big $46.8 billion?

- What do the disparities in percentages of non-IaaS revenue—42.2% for Amazon and 78.7% for Microsoft—have to say about each company’s preparedness and capabilities to take business customers swiftly and successfully into the digital economy?

- Microsoft’s public-cloud IaaS revenue might be only half the size of Amazon’s but Microsoft’s is growing more than twice as fast—59.2% versus 28.7%. What does that say about the future of this hyper-dynamic marketplace?

But, that would have required some fresh thinking, and perhaps Gartner doesn’t have a 3-ring binder from 2007 that offers that answer—so it’s better to avoid those types of questions.

And it’s safer to drop brain-busters like this: “While the cloud market will continue to grow.”

RECOMMENDED READING

Google Squeezed Out by Amazon & Microsoft in Battle for Salesforce Love

Oracle Challenges SAP, Microsoft, Salesforce over Industry-Cloud Suites

Is Salesforce Going to War with Oracle, Workday, SAP in HR?

The Marc Benioff Show: Inside Salesforce’s Greatest Quarter Ever

Microsoft CEO Satya Nadella Is World’s #1 CEO: 5 Reasons Why

Oracle CEO Safra Catz More Bullish Than I’ve Ever Seen: 10 Examples

Larry Ellison Shows His Cards: Oracle ERP Revenue Could Reach $30B

Meet Google Cloud’s Secret Weapon: OCTO

Salesforce Targets ServiceNow: Slack Delivers “Human Workflow”

SAP Buries the Past: Calls Out Legacy ERP, Welcomes Modular Cloud ERP

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.