Belittling the capabilities of peers that are beating Oracle in some key markets, Oracle chairman Larry Ellison is playing a high-risk game of trashing the competition to mask his own company’s lengthy and low-growth transition to the cloud.

While Ellison’s taunts—a blend of truth, half-truths, and flat-out fantasies—can be entertaining and a little catchy, Oracle’s competitors have all begun playing a very different game. For them, the objective is no longer to out-insult your rivals, but instead to dazzle and delight your customers.

In Oracle’s fiscal Q2 earnings call last week, 4 points rang home loud and clear to me from the company I’m currently ranking at #5 on my Cloud Wars Top 10 list.

- Oracle’s overall revenue for the quarter grew 1%.

- Ellison would like the market to believe that SAP and Workday are bumbling at best and incompetent at worst—in spite of the fact that both have higher growth rates in the cloud than Oracle does.

- Oracle will eventually vanquish all of its cloud competitors, if everyone would just regard those competitors the way Ellison does.

- The two products that Ellison says will determine Oracle’s fate—the Autonomous Database and Cloud ERP—will eventually be enormously successful, if everyone buys them and if Oracle’s competitors agree to be frozen in time and stop improving and competing.

The Serious Challenges Oracle Faces

Regarding competitors and Oracle’s ultimate success, there’s a whole lotta “if’s” and “eventually’s” in that list above.

And the only hard-and-fast fact among the 4 is that Oracle’s overall growth for the quarter ended Nov. 30 rose by 1%.

I freely admit that I’m a huge fan of Larry Ellison. I believe he will be forever regarded as one of the greatest business leaders and strategists of our time.

But not even Larry Ellison has invented a time machine. And if, as Ellison hinted at during the earnings call, it’s going to take 18 or 24 months for significant revenue from Autonomous Database to show up, then in the interim he’d better create a new way to frame and articulate Oracle’s value. (You can see more on that at Hello, IBM and Microsoft: Larry Ellison’s Big Plans for Oracle Autonomous Database.)

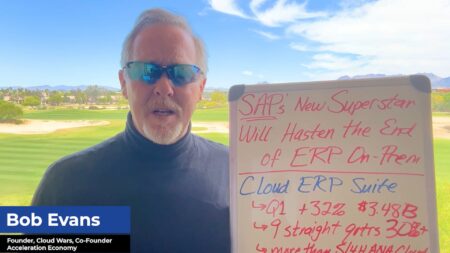

The approach of “my competitors are terrible” has run its course. It is no longer freezing the market until Oracle can catch up. And don’t take my word for it—just look at the ongoing cloud-growth rates from SAP and Workday, both of which are higher than Oracle’s. For more on that, please check out these articles.

ORACLE vs. SAP vs. WORKDAY

Workday Says High-Flying Financials Business Will Surpass Flagship HCM

Cloud Revenue Super-Surge: Salesforce and SAP to Top $51 Billion for 2023

How Salesforce Plans to Defeat Oracle and SAP While Scaling to $35B

SAP Rides Microsoft Deal to First $2-Billion Cloud Quarter as McDermott Era Ends

Exclusive 1:1 with Aneel Bhusri: Machine Learning Changes Everything

SAP and Oracle’s Larry Ellison Just Can’t Agree: Who’s #1?

Attention Salesforce: SAP CX Revenue Surges 75%, Key Exec Jumps Ship

Archrivals Oracle and Workday Agree on One Thing: SaaS Market Booming

So from the earnings call, I’ve compiled two lists. First, we’ll look at some of the increasingly irrelevant criticisms Ellison leveled at SAP and Workday. And second, we’ll turn to some of the very positive possibilities that could become reality for Oracle in the near future.

And it is that second list—the stuff about why Oracle’s products and services are uniquely qualified to drive significant new innovation and value for customers—that Ellison and Oracle should focus on exclusively in the future. Because, as I noted above, that’s the approach customers are looking for. Most of the Cloud Wars Top 10 vendors have jumped on it already.

Ellison’s insistence on playing the insult-your-competitor game is not only old-fashioned, it also obscures Ellison’s ability to hammer home the unique and high-value attributes of the Oracle Cloud and Cloud ERP and the potentially runaway Autonomous Database.

Oracle’s Insults

- “Workday’s lack of success in cloud ERP is creating opportunities for Oracle in Cloud HCM.”

- “SAP’s customer base is up for grabs. They didn’t rewrite their applications for the cloud. That has created an enormous opportunity for Oracle.”

- “Go to SAP’s website and try to find the SAP cloud for ERP. I mean, you can find it for the stuff they bought—you can find it for Callidus, which is on one cloud. You can find it for Ariba, which is on another cloud. I mean, you can find it for little SurveyMonkey and all the stuff that they bought.” (Of course, SAP did not buy “little SurveyMonkey.” It bought Qualtrics, which has been a highly significant factor in SAP’s cloud growth exceeding that of Oracle.)

- “But they forgot to rewrite ERP. That’s their business, and they forgot to rewrite ERP there. The projects that they had to do, they’re called Business ByDesign, failed. They canceled it.” (No, SAP certainly has not canceled Business ByDesign—check out this link to the Business ByDesign pages.)

- “They can’t go to Workday. Workday can’t even handle mid-market ERP. So we’re it.” (That’s another baseless and absurd claim. The truth is that Workday’s Financials business is growing more than 50% year-over-year, and CEO Aneel Bhusri just said that within a few years, that business will be larger than its flagship HR business.)

- Ellison even managed to take a swipe at Amazon during his discussion of the hybrid-cloud market when he dismissed the concept behind the AWS Outpost product: “Now, all of our cloud competitors are trying to create these ‘outposts’ of their cloud on the floors of their customers.”

Okay, enough of that silliness.

And as promised, here are some high-value comments from Ellison about the ways in which he sees his two most-strategic products—Cloud ERP and Autonomous Database—grabbing the attention of customers.

Oracle’s Potential

- “We have a huge lead in cloud ERP with over 7,000 Fusion ERP customers and 20,000 NetSuite ERP customers.”

- “More and more, we are seeing HCM being purchased as a part of an ERP Cloud application suite… And we’re beginning to see that same integrated-suite strategy drive our sales of CX—customer experience—applications in sales, service and marketing.”

- “We already have thousands of Autonomous Database customers running in our public cloud, and we added 2,000 more this quarter… It’s growing in excess of 200%—off a small base, admittedly; it’s a relatively new product—but it’s on its way to being the most successful new-product introduction in our company’s history.”

- “A lot of our customers—especially those in regulated markets, big banks, government agencies, defense ministries—need the Autonomous Database capabilities behind their firewall in their data center. And over the next few months, we’re rolling out this Autonomous Database Gen2 Cloud at Customer.”

- “By the end of 2020—by the end of next calendar year—I’ll be able to say that we have more Gen2 data centers in more countries than Amazon Web Services have data centers, period. We’re adding lots and lots of data centers in lots and lots of countries.”

- “So yes, when you buy ERP, you’re also going to buy the Fusion Data Warehouse, which is an Autonomous Database product and infrastructure product. You’re going to buy analytics in our Gen2 data center. You can become an infrastructure customer, as well as an application customer.”

Closing Thought

As colorful and combative as Ellison is, and as wildly successful as he’s been, what he and Oracle are facing today with extremely capable, fast-moving and customer-obsessed competitors is unlike any of the competitive battles he’s fought through in the past.

And yesterday’s tactics won’t work in today’s modern marketplace.

It’s time, Larry, to stop trashing the competitors and to start celebrating the customers.

Disclosure: at the time of this writing, Oracle was a client of Cloud Wars Media LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!