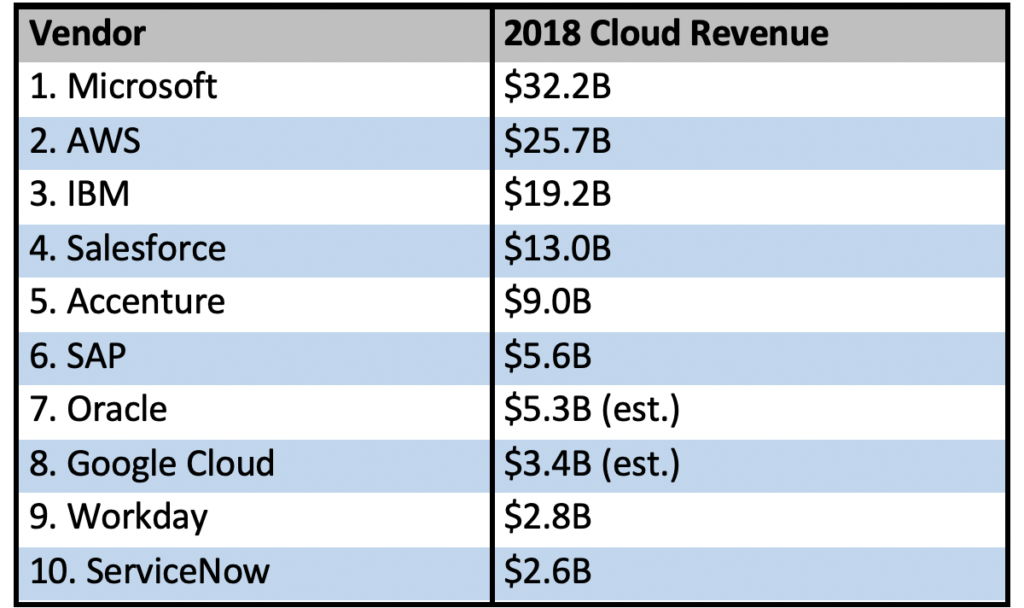

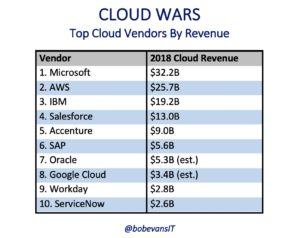

As one of the greatest growth markets in the tech industry’s history is just beginning to hit its stride, the 10 biggest enterprise-cloud vendors racked up total revenue of almost $120 billion during 2018, led by #1 Microsoft at $32.2 billion, #2 Amazon at $25.7 billion, and #3 IBM at $19.2 billion.

The biggest surprise to me on this list was the emergence of Accenture as a truly big-time player with 2018 cloud revenue of $9 billion, up 23% from 2017.

Overall, these numbers reveal how the cloud has moved rapidly from a peripheral idea that was potentially interesting but strategically sketchy to the mainstream platform for digital transformation, AI, and customer-centric business models and execution.

At the growth rates most of these companies are achieving, it’s more than likely that for 2019, the total revenue will jump from about $120 billion to more than $150 billion.

Here are some thoughts on each of the cloud vendors on this list, which should not be confused with my Cloud Wars Top 10 rankings. Today’s list is based solely on annual revenue, whereas the ongoing Cloud Wars Top 10 rankings are driven by a range of factors that include but are not limited to revenue. So you can compare the two, I’ve attached this week’s Cloud Wars Top 10 ranking at the bottom of this article.

- Microsoft: $32.2 billion. In its generally understated way, Microsoft has masterfully blended its power of incumbency in Office 365 Commercial and Microsoft 365 with high-innovation expansions via HoloLens, Azure Stack, Cosmos DB and others with superb big-scale acquisitions of LinkedIn and GitHub. The result is an unmatched set of capabilities for business customers looking to thrive in the digital economy.

- Amazon Web Services: $25.7 billion. The category king in IaaS had another exceptional year and intensified its expansion into the database market by vowing finish ripping and replacing all of its Oracle databases with its own data-management tools by the end of this year. AWS’s relentless product-development engines are deepening its ties with existing customers and attracting lots and lots of new ones, and CEO Andy Jassy was our Cloud Wars CEO of the Year for 2018.

- IBM: $19.2 billion. IBM plays its own game in the cloud, eschewing the detailed breakout of services across the three layers of IaaS, PaaS and SaaS that most cloud vendors use, but nevertheless delivered almost $20 billion in cloud revenue in 2018. Toward the end of the year, it began locking down its cloud story around openness, cybersecurity, and unmatched expertise in hybrid cloud and multi-cloud. And the market is expecting big payoffs from the $33-billion acquisition of Red Hat.

- Salesforce: $13 billion. The category king in SaaS had another excellent year but is facing some very interesting competition from rivals who want to redefine the category that Marc Benioff created exactly 20 years ago. Salesforce has clearly shown it can dominate on the playing field it created—can it adapt to or simply overwhelm the new approaches that expand beyond traditional CRM to supply chain and customer experience?

- Accenture: $9 billion. In the messy world where some on-premises systems stand their ground, others morph into private clouds, and still others head for the latter-day glue factory, and in which rogue departments are deploying cloud services without the full blessing of central IT, and where most people expect somebody else to figure out how to make it all work together, Accenture’s ability to offer strategic guidance along with highly innovative technology has made it a rapidly emerging force in the cloud marketplace.

- SAP: $5.6 billion. Amazing to see the end-to-end transformation within this iconic tech company as its cloud business grew about 40% in Q4 even without including the acquisition of wildly disruptive Qualtrics, which is growing at even higher rates. Qualtrics and its customer-experience expertise allows SAP to combine that with its ERP and operational-data expertise to offer a range of capabilities that no other cloud company can match. I think SAP will be the most-interesting cloud company to watch in 2019.

- Oracle: $5.2 billion (estimated). Oracle stopped breaking out its cloud revenue a few quarters ago so it’s impossible to get a specific fix on where the company’s cloud business stands. But it has said that its internally developed Cloud ERP and Cloud HCM businesses did about $650 million in revenue for the quarter ended Nov. 30, and Oracle’s Autonomous Database recently got rave reviews from customer TaylorMade Golf. All the pieces are there—can Oracle put together a cohesive cloud story in 2019?

- Google Cloud: $3.4 billion (estimated). The big story here is the manner in which new CEO Thomas Kurian—formerly a longtime top executive at Oracle—is remaking Google from a technology powerhouse with dismal sales presence to an aggressive competitor that intends to build sales organization on par with the company’s vaunted tech capabilities. It’s a huge task but clearly has the full backing of the immensely deep-pocketed parent company—and if anyone can lead Google Cloud to its full potential, that person is Kurian.

- Workday: $2.8 billion. Surging on the acquisition of Adaptive Insights and the new-found ability to deliver an entire ERP suite, Workday’s growth rate picked up in late 2018 and its prospects for this year are excellent in not only its flagship HCM business but also ERP and particularly Financial. The company also has said its deployment methodology is reducing customer costs significantly, and that it intends to push that new model out across the globe.

- ServiceNow: $2.6 billion. The digital-workflow company continues to thrive with its unique approach toward changing how companies work rather than focusing on specific applications. Under CEO John Donahoe, ServiceNow was recently named the world’s most innovative company, and a combination of new products and increasing visibility and awareness are making 2019 look very promising as well.

Disclosure: At the time of this writing, Microsoft, IBM, SAP, and Oracle are clients of Evans Strategic Communications.

*******************

RECOMMENDED READING FROM CLOUD WARS:The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!