A multi-pronged AI program from Amazon aims to train two million people through new courses, a scholarship program and a generative AI curriculum created with Code.org.

Amazon

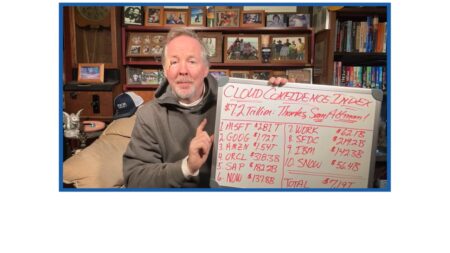

The Cloud Confidence Index hits a record $7.2 trillion, reflecting heightened interest in AI-driven innovation, with Sam Altman’s brief move to Microsoft adding intrigue and cementing Microsoft’s dominance in the cloud market.

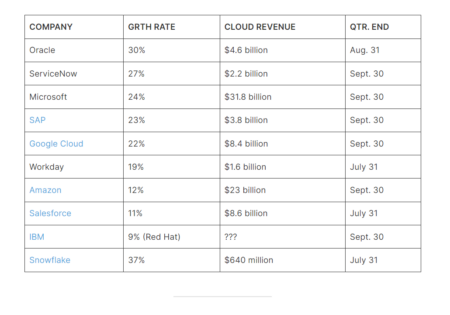

In the Cloud Wars landscape, Oracle leads with a remarkable 30% growth rate, closely followed by ServiceNow and Microsoft at 27% and 24%, respectively, with Microsoft’s FY24 Q1 standing out as an extraordinary quarter, contributing $6.1 billion in incremental cloud revenue.

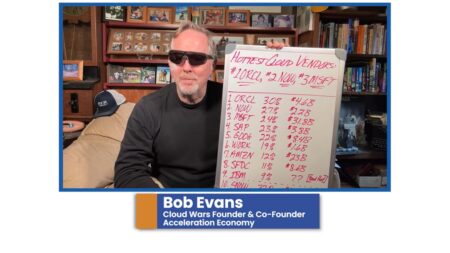

In the latest Cloud Wars Minute, Oracle leads the hottest growth companies with a 30% growth rate, hitting $4.6 billion in cloud revenue.

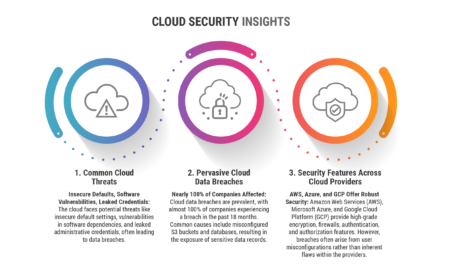

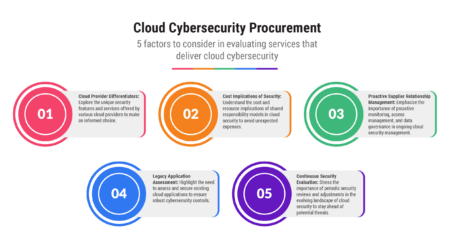

The big three cloud service providers AWS, Azure and Google Cloud share but also differ on features and vulnerabilities.

At first glance, cybersecurity models among cloud providers may seem like near carbon copies of each other, but a bit of digging can yield some real differences.

AWS partners with blockchain gaming startup Immutable, which joins the Amazon Accelerate program and plans infrastructure collaboration.

Google Cloud’s Q3 growth rate dropped to 22%, with CEO Sundar Pichai attributing it to customers optimizing spending.

AI Index Report Ep 14: Mistral AI launches its first model, Mistral 7B; Amazon invests in Anthropic to compete with rivals; OpenAI releases DALL-E 3 multimodal updates.

Workday is partnering with AWS to provide AI services through its platform, accelerating its expansion into the AI ecosystem.

BMW Group’s advanced driver assistance system (ADAS) will equip a new line of vehicles; AWS will play a critical role in providing the required infrastructure.

The Cloud Wars Top 10 are in the thick of quarterly financial reports. The numbers and outlook are making it clear: some investment caution is dissipating.

An update on the Cloud Confidence Index, with Amazon, Google, and SAP leading the index higher.

AWS fell to #3 on the Cloud Wars Top 10, as supply chain innovations and corporate strength are not enough to facilitate growth to combat cloud competitors.

The Cloud Confidence Index uses market caps of top 10 cloud companies as a proxy for business leaders’ confidence in their growth, reflecting customer demand and technology trends. The index is up slightly.

AWS unveils a game-changing Cyber Insurance Program to address common challenges in the cyber insurance market, offering quick quotes, multiple insurer options, and use of AWS services for streamlined assessments.

Approaching the release of the Q2 financial results of Amazon, AWS’ growth rate decline stands out relative to Cloud Wars Top 10 adversaries.

AI Index Report episode 3: IBM releases watsonx.ai platform for enterprises; Databricks acquires MosaicML for $1.3 billion; and Amazon announces Amazon CodeWhisperer copilot.

J.P. Morgan’s Payments Partner Network and Six Flags’ new payment technology implementations demonstrate the power of ecosystem partnerships for innovation and value creation.

Market-leading growth rate, compared with the decline in AWS’ growth, raises the specter of Oracle overtaking Amazon in the Cloud Wars Top 10.