A federal watchdog group’s dareport exposes major flaws in Microsoft’s cloud cybersecurity, demanding urgent action from CEO Satya Nadella to address widespread shortcomings and restore customer trust amidst escalating cyber threats.

Earnings Call

A look into the AI Ecosystem, spotlighting the strategic investments of Cloud Wars Top 10 companies like Amazon and Google into AI startups like Anthropic.

Oracle’s fiscal-Q3 cloud revenue surpasses license-support revenue, marking a major milestone in the company’s transformative journey, fueled by strong growth in Oracle Cloud Infrastructure and AI services.

The Microsoft-Oracle partnership is reshaping the cloud industry by breaking competition boundaries, fostering interdependence, and creating new growth opportunities globally.

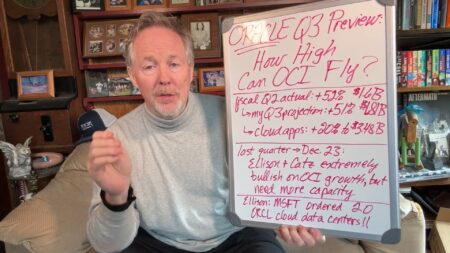

Oracle announces 40 AI deals totaling $1 billion and strong Q3 cloud growth at 25% to $5.1 billion as well as reveals plans for the world’s largest AI data center.

Oracle reported strong Q3 results with $5.1 billion in total cloud revenue, up 25%, but acknowledged falling short of meeting customer demand due to data-center capacity constraints.

Oracle is expected to deliver a 51% increase in Q3 cloud-infrastructure revenue, underlining its prowess in attracting major clients and reshaping industry dynamics.

Insights into Oracle’s fiscal Q3 results, which are likely to reveal remarkable growth for Oracle Cloud Infrastructure (OCI).

Frank Slootman’s successor as Snowflake CEO, Sridar Ramaswamy, brings a strong AI background and strategic vision to drive the company forward.

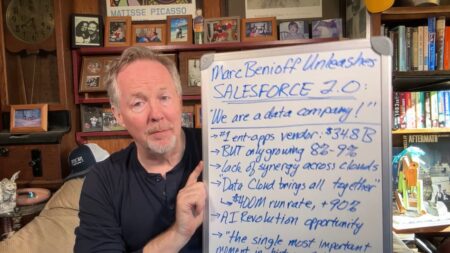

Salesforce CEO Marc Benioff declares the company’s transformation into a data company amid slowing growth projections for its core business.

Salesforce is making a strategic shift towards prioritizing higher margins over growth, which entails a new focus on its identity as a data company and addressing challenges in synergy among its legacy clouds.

Businesses exhibit strong confidence in cloud and AI, reflected in soaring RPO and backlog figures from Workday, Snowflake, and Salesforce. Substantial long-term commitments highlight aggressive investments in these companies’ software.

As Workday co-founder Aneel Bhusri steps down from his CEO role to become executive chair, he’ll focus on strategic innovation while CEO Carl Eschenbach drives revenue growth.

Workday’s Q4 results showcase a robust fiscal performance with a 19% surge in subscription revenue, hitting $6.6 billion for fiscal 2024.

Highlighting optimistic subscription-revenue trends for Workday, decoding Salesforce’s cautiously optimistic signals for a potential growth turnaround, and expecting continued strong growth for Snowflake driven by AI and expanding data initiatives.

Andy Jassy claims AWS had the cloud market’s highest incremental revenue gain, overlooking Microsoft’s superior figures, leading to questions about his perception of cloud services.

Google boosts investments, allocating $11 billion in Q4 2023 and eyeing $50 billion in 2024 for technical infrastructure, fueled by the GenAI Revolution and Gemini AI models.

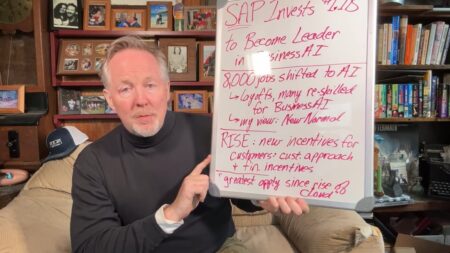

SAP CEO Christian Klein is making a substantial commitment to Business AI, investing $1.1 billion and shifting 8,000 positions amid the GenAI Revolution.

SAP is investing significantly in AI for future success and reconstituting positions to meet customers’ evolving needs.

A reflection on Microsoft CEO Satya Nadella’s tenure, which has seen the remarkable transformation from a ‘Cloud-First’ vision to Microsoft’s dominance in the cloud.