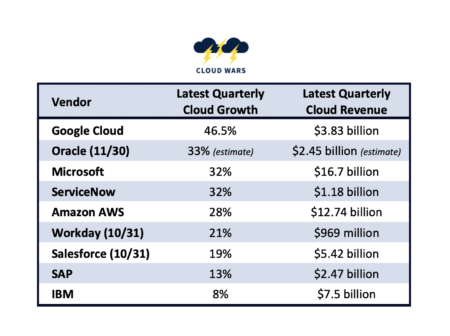

Google Cloud Q4 growth happened far more rapidly than any other cloud provider, but that’s not because the others were slacking.

Top 10

ServiceNow has jumped two spots on the weekly Cloud Wars Top 10 rankings to the #7 slot, knocking IBM down to #9.

Powered by its 12-month run as the world’s fastest-growing major cloud player, Google Cloud has claimed the #3 spot on the Cloud Wars Top 10.

The day we thought would never arrive —the end of 2020!!— is here and I’d like to share my choices for the Top 10 Cloud Wars stories of 2020.

Despite being the core of the greatest growth market the tech industry has ever known, cloud vendors face significant challenges.

Workday has competed, won, and excelled against its larger rivals while also winning awards for being a fabulous company to work for.

An in-depth analysis of how Bill McDermott plans to quickly drive ServiceNow from $4 billion in annual revenue to $10 billion.

IBM’s cloud business is in great position to have a breakout year in 2021, but IBM will need to fully commit its full resources to the cloud.

An in-depth analysis of Oracle from 5 different perspectives: Opportunities, Challenges, Differentiation, Leadership, and Big Questions.

Ready to turn its dreams of transcending traditional ERP into reality, SAP to bring the full promise of the Intelligent Enterprise in 2021.

Since taking over as Google Cloud CEO in January 2019, Kurian has turned his company into the hottest enterprise-cloud vendor in the world.

Six takeaways from CEO Andy Jassy’s opening keynote to the AWS re:invent conference, including the impact COVID-19 has had on cloud adoption.

Betting $28 billion that Slack will help Salesforce stay ahead of hard-charging Oracle and SAP, Marc Benioff is redefining his company.

In kicking off this Special Report with #1 Microsoft, I put forth the idea that Microsoft’s most-valuable attribute is its customer approach.

Microsoft will face intensified pressure to hold the #1 spot in 2021 from Google, Amazon, and a few of the world’s other top cloud vendors.

As we head into Q4, here are my thoughts on the 5 world-shaping tech vendors making up the top half of the Cloud Wars Top 10 rankings.

My rationale for giving credence to Larry Ellison’s claim—and, more important, his belief—that Oracle can rise to the top of the IaaS market.

Chairman Larry Ellison makes the case that when it comes to Oracle Cloud, the big dog is OCI—Oracle Cloud Infrastructure.

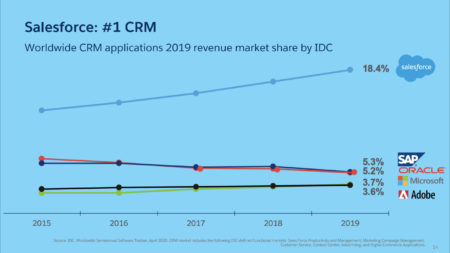

Following its release of quarterly results, cloud leader Salesforce’s shares shot up by 25%, giving it a market cap of almost $250 billion.

In its Q2 earnings presentation, Salesforce included a CRM revenue market-share chart from IDC showing its increased dominance in 2019.