Discover the benefits of financial corporate performance management (FCPM) strategies, and software required to roll them out successfully.

Search Results: risk management (691)

The responsibilities of Chief Financial Officers have changed over time. Read about the role of the CFO, beyond just financial management.

Founded in 1879, Funk Group is one of Germany’s most prominent independent risk consultants and insurance brokers. Currently, the company…

In this piece, learn why investing in cloud data analytics, artificial intelligence, and following a cloud migration strategy can help businesses overcome future problems, whether it’s a pandemic supply chain disruption or a cyber attack.

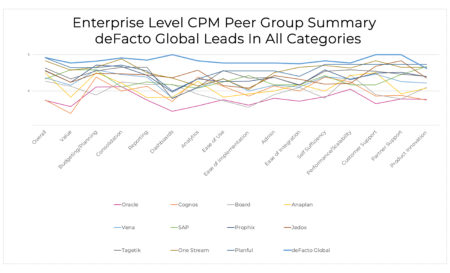

For the second year in row, deFacto Global has outperformed every other vendor across a full range of criteria. No other vendor has achieved that honor throughout the history of the awards.

Many organizations face challenges in controlling spending and navigating disjointed approval processes. Medius has developed solutions that can streamline these processes and reduce risk.

Managing your physical assets can be challenging as the pace of business has increased dramatically. So, how can your ERP and Enterprise Asset Management (EAM) work together?

Check out this blog to discuss how to mitigate implementation risk using Microsoft Dynamics 365.

The complexities of database migration were highlighted unexpectedly on recent earnings calls for Snowflake and Google Cloud.

Check out this blog to discuss the top four ways Microsoft D365 decreases financial complexity and risk for manufacturers.

The “transformation” buzzword is everywhere these days, and there’s no doubt that far-reaching, systemic change can deliver impressive results, especially when powered by new digital platforms. But transformation enthusiasm should be tempered by an understanding of the potential downsides

deFacto Global is proud to announce it earned the “Highest Overall Satisfaction” Award, outperforming all other Corporate Performance Management vendors in BPM Partners’ “Pulse of Performance Management 2020” Awards. deFacto Global was also the highest ranked vendor serving the mid to enterprise market for “Financial Self-Sufficiency”, “Financial Consolidation Functionality”, “Budgeting and Planning Functionality” and “Ease of Use”.

Learn about tools that can assist in data management in an ERP implementation project.

The majority of CRM systems have duplicate data to some degree, that is no mystery! We cover the cause and effect of this data- including GDPR compliance issues. We cover how to design out duplicate data and reduce the risks of adding duplicate data! Learn processes you can put in place to reduce it and how to address it if you have it. Duplicate data management starts with policies and processes, with a little help from technology you can deal with it & improve user adoption and customer satisfaction.

RadiusOne A/R Credit Risk Management App enables automated credit risk evaluation and credit scoring to standardize credit approval process and enable credit teams to make faster and more accurate credit decisions.

With ready-to-use credit application templates, integration with credit agencies and automated credit scoring models – configured based on the industry-specific best practices, fastrack your credit management process for new businesses and streamline periodic reviews. Free up your analysts’ time with workflows and automated correspondence for internal and external collaboration. Enable centralized access to all credit information for high-yield decision making, compliance and eliminate paper-costs with electronic storage.

Additional credit management functionality has been added to Dynamics 365 to enhance your ability to better track credit limits for customers, block sales orders from credit risk customers, and automatically release sales orders from credit holds. In this session, we’ll demonstrate how a customer’s environment was configured to maximize the use of this new feature. We will demonstrate multiple ways in how the credit management functionality better served the customer’s business.

This session is geared to users with a beginner to intermediate-level knowledge of the subject area.

This session will be available for CPE credits pending completion of session survey post event.

The upcoming SEC rules delve into cybersecurity transparency, incident reporting, and risk management procedures.

The funded startups run the gamut from AI for fresh produce and ESG risk management to farm management and a buyer of Shopify merchants.

In this Cloud Wars News Desk interview, the managing director of Google Cloud’s global insurance and risk management solutions discusses how the company is pioneering new technologies for financial service partners.

As supply chain complexity has exploded, CISOs need to map out the risk management strategies for their organizations.