New data clean room app — integrated into the Snowflake Data Cloud — makes cross-company, cross-cloud data sharing secure and easily accessible.

AWS

C3AI has launched its no-code, self-service GenAI capabilities on Google Cloud Marketplace, expanding its reach to more customers.

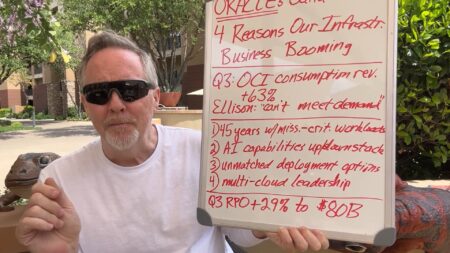

An exploration of Oracle’s infrastructure business, detailing its growth, competitive landscape, and strategic shifts as well as AI’s role.

While Microsoft plans a $100-billion data center with OpenAI, Oracle diverges by favoring numerous small data centers worldwide.

Leveraging Google’s cybersecurity intelligence, Google Cloud emerges as a formidable player, poised to capitalize on market opportunities amid competitive challenges.

Amazon’s AWS Generative AI Competency program streamlines GenAI adoption by offering a curated network of over 40 partners.

A federal watchdog group’s dareport exposes major flaws in Microsoft’s cloud cybersecurity, demanding urgent action from CEO Satya Nadella to address widespread shortcomings and restore customer trust amidst escalating cyber threats.

Oracle reported strong Q3 results with $5.1 billion in total cloud revenue, up 25%, but acknowledged falling short of meeting customer demand due to data-center capacity constraints.

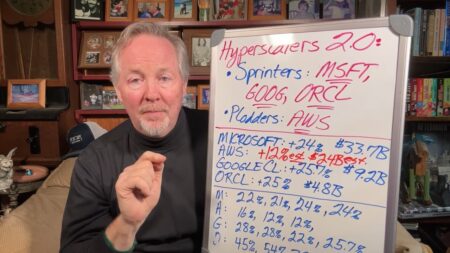

Has Microsoft surpassed AWS as the leader in the enterprise cloud? Financial figures show Microsoft’s cloud revenue consistently outpacing AWS.

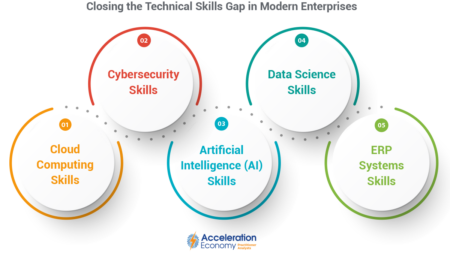

In order to prepare companies for the future of technology-driven business, it’s incumbent upon CIOs to identify and actively address the most critical tech skills gaps.

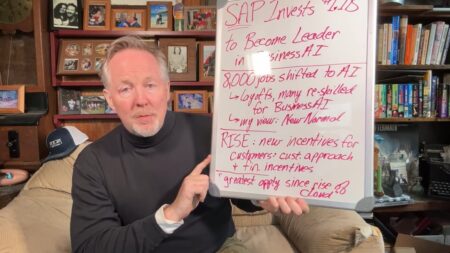

SAP is investing significantly in AI for future success and reconstituting positions to meet customers’ evolving needs.

Verusen, a startup with AI and neural network technology to optimize supply chains, focuses on data cleansing of MRO inventory.

The NFL has continued its partnership with AWS to develop tools using AI and machine learning to advance analytics in the sports industry, and AWS’ technology will feature prominently in the Super Bowl.

AWS, once the undisputed leader, is struggling to keep pace with the rapid growth and customer-focused innovations of Microsoft, Google, and Oracle in the cloud market.

The cloud hyperscalers are splitting into two distinct groups: sprinters (Microsoft, Google Cloud, and Oracle) and plodders (AWS).

AI Index Ep 24: Accenture and Unilever announce partnership for GenAI; Amazon fund invests in robotics and AI; and Vertice provides cloud expense management.

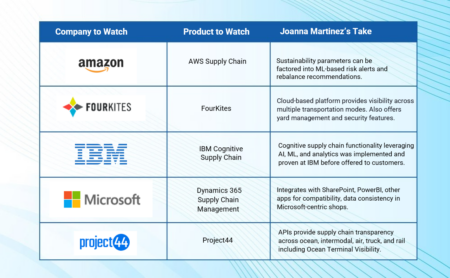

Innovation often comes from start-ups, but several of the biggest software firms — AWS, IBM, Microsoft — are able to prove their technology in their own complex supply chains.

SAP CEO Christian Klein details the role of artificial intelligence (AI) in enhancing core business functions, and how SAP programs including RISE help customers.

Our top products to watch this year range from applications with comprehensive supply chain functionality to transportation-focused specialty apps.

AWS seeks to narrow the generative AI competitive gap through a strategic partnership with Siemens.