C3AI has launched its no-code, self-service GenAI capabilities on Google Cloud Marketplace, expanding its reach to more customers.

Financial Services

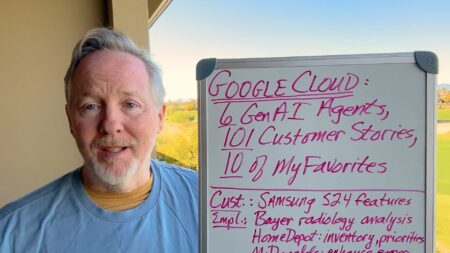

Customer stories from leading companies illustrate how six GenAI agents are streamlining tasks, freeing up professionals for higher-level analytical work.

The financial services sector has embraced AI for many functions, including analysis and decisions regarding investing in companies.

Apromore co-founder Marlon Dumas details where GenAI fits in customers’ plans, the need for predictive functionality, and why time to value is so important today.

As innovative startups develop more use cases for GenAI, the banking industry has been exploring the AI ecosystem, especially for customer-facing workflows.

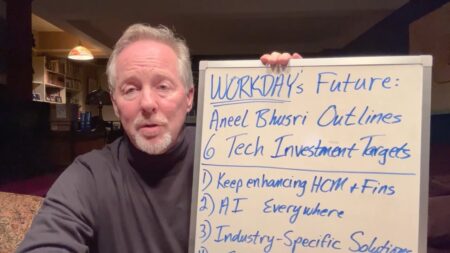

Workday’s co-founder Aneel Bhusri transitions to executive chairman, and cites six key strategic areas, including AI integration, industry-specific solutions, and cybersecurity, as the company aims to double revenue to $15 billion.

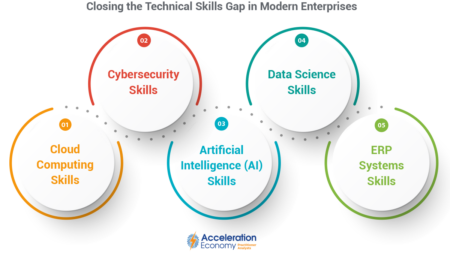

In order to prepare companies for the future of technology-driven business, it’s incumbent upon CIOs to identify and actively address the most critical tech skills gaps.

ServiceNow aims to enter the customer-relationship management (CRM) sector, with CEO Bill McDermott citing a “tremendous opportunity” to reshape CRM through AI-powered workflows.

Arvind Krishna discusses leveraging technology to streamline processes in industries like banking and pharmaceuticals, aiming to enhance productivity and address regulatory challenges.

A discussion with Snowflake CEO Frank Slootman on data strategies and the transformative impact of AI for CEOs, business applications, and industries.

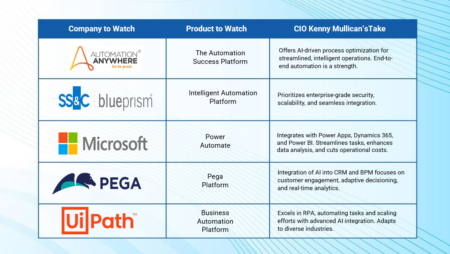

A look at five automation products that can transform businesses, including offerings from Microsoft, UiPath, Automation Anywhere, and more.

AWS seeks to narrow the generative AI competitive gap through a strategic partnership with Siemens.

Celonis co-CEO and co-founder Alex Rinke discusses the introduction of the Process Intelligence Graph and the recent acquisition of Symbio, offering a comprehensive view of business processes and driving value for customers in complex environments.

Customer sessions will explore how process mining and generative AI can be applied across industries at Celopshere 2023.

The challenges posed by the growing use of generative AI, including cost increases and sustainability concerns for data centers.

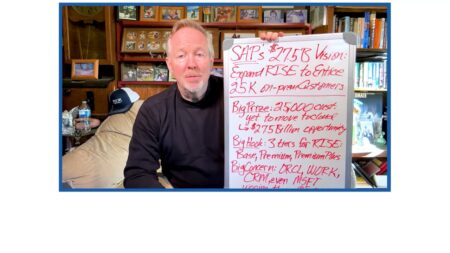

SAP is expanding its successful RISE program to convince 25,000 of its on-premise customers to transition to the cloud.

Oracle’s executive vice president of industries, Mike Sicilia, discusses the transformation of core businesses in various industries through Oracle’s cloud offerings.

C3 AI has launched its C3 Generative AI for Industries, Business Process, and Enterprise Systems that addresses specific use cases in key business areas.

A conversation on the partnership between Automation Anywhere and Cognizant, focusing on transforming industries through Intelligent Automation.

Automation Anywhere Imagine highlighted how intelligent automation and generative AI can enhance the future of work.