A computerized maintenance management system (CMMS) can undoubtedly be crucial to any plant’s management strategy. It helps you to ensure…

Search Results: software (2271)

Navigating the financial close is anything but a straightforward process. Multiple key departments and members are involved, documents are being…

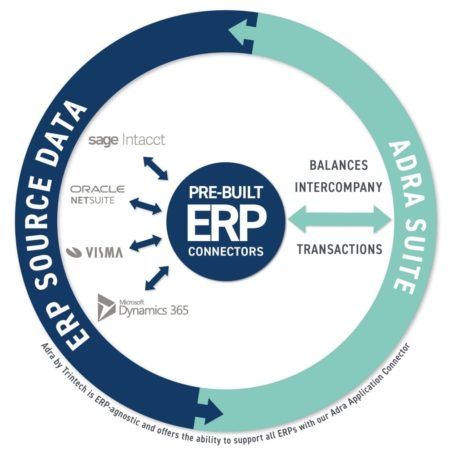

Enterprise resource planning (ERP) systems house an abundance of information detailing a company’s operations, from financials to cash flow to…

In this Cloud Wars Live episode, I talk with Bonnie Tinder about the need for “just right” software, or the Goldilocks Strategy.

Microsoft’s most popular ERP software Business Central has has both Assembly and Manufacturing capabilities. Which functionality should you be using?…

With businesses wanting to increase their abilities and efficiency, ERP (Enterprise Resource Planning) tools with AP (Accounts Payable) automation are…

You’ve done your research. You know your corporate indirect tax department could benefit from comprehensive tax technology. You’ve looked into software options and started building your business case. However, the most critical question remains: How are you going to fund the investment?

If you know where to look, you’ll uncover costs that will more than justify the decision to purchase comprehensive indirect tax software to manage your global sales and use taxes, value-added taxes (VAT), and goods and services taxes (GST). Here we take a look at several areas where potential time and cost savings overwhelmingly validate the investment in indirect tax technology.

How do you sort through all the choices and find the right software vendor to automate your indirect tax process? Use these questions as you evaluate vendors. The software vendor that provides the most items in the list will best support your indirect tax automation needs.

Cloud software solutions eliminate the burden of system administration and maintenance so management can focus on value-added activities. They remove the need for IT teams to manage on-premise implementations that are tough to forecast from a resourcing perspective. They reduce costs significantly while providing better service, more agility and greater security.

Most modern corporations whose goal is to stay tax compliant decide to use integrated tax software. It is the only way to automate the end-to-end tax automation process and allow your indirect tax department to spend more time on the activities that bring value to your business.

This whitepaper shows how these corporations benefit from integrated tax software and how it helps them stay tax compliant.

Learn how to get maximum benefit from your implementation partner’s experience and knowledge on your Dynamics 365 implementation.

Meet Joe, who quickly learns that shipping without a connected system like Pacejet is a big mistake.

In this piece, we define what RPA is, what RPA isn’t, and the business processes it solves!

HSO’s DynamicsAdvantage is an end-to-end solution that empowers organizations to move from being reactive to providing predictive field service.

An integrated CRM and ERP system provides real-time financial data, accelerating your delivery of services to constituents, with increased accountability.

Watch how Kohler leverages Microsoft Office 365 and Microsoft Dynamics 365 to bridge the gap.

Software is becoming an essential strategy of non-software companies. With distinctive, codified knowledge, businesses can scale ROI with digital platforms

Has the COVID-19 pandemic caused you to reevaluate the way you do business? Now may be a good time to invest in your organization’s future ERP Software!

Zenlayer, a thriving multinational cloud services provider, partnered with BCS to upgrade their software applications to Business Central.

As things in every industry are changing incredibly fast, all leaders can learn from the outlook McDermott cultivates inside ServiceNow.